微纳芯MNCHIP_小型便携式全自动生化分析仪_快速微流控生化分析仪_POCT

Articles

Placing monitor topic you to advertises your online business on the car doesn’t replace the access to your vehicle of individual used to organization play with. If you are using which car to own driving and other personal spends, you still is’t deduct your expenses of these uses. Charges you only pay in order to playground your car at the host to company is actually nondeductible driving expenditures. You could, however, subtract team-relevant vehicle parking costs when visiting a customers or consumer. You always is also’t deduct the costs if the put aside fulfilling is actually stored to the a day on which your wear’t focus on their normal employment. In such a case, your transport can be an excellent nondeductible commuting bills.

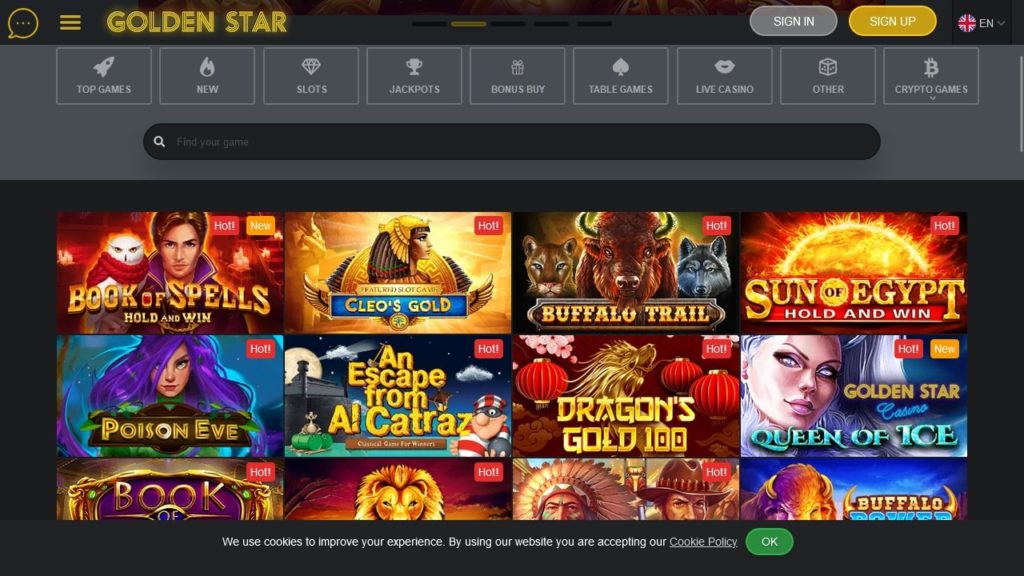

Casino Lucky Red login – Cracking Development

Essentially, a short-term project in a single venue is one that is logically anticipated to history (and you may do indeed history) for example season or quicker. You are used by a good transportation business that has its critical in the Phoenix. At the conclusion of your a lot of time operates, you come back to your house terminal in the Phoenix and you may purchase you to night there just before going back family. You can’t subtract one expenses you’ve got for food and you can accommodations within the Phoenix or even the cost of travelling out of Phoenix so you can Tucson. For those who (and your members of the family) don’t real time at the tax family (discussed earlier), you could’t subtract the price of travel amongst the income tax family and all your family members house.

What is the Taxpayer Suggest Services?

Which rule doesn’t apply when you have a bona-fide, separate organization connection with one loved one and also the current isn’t intended for the client’s ultimate fool around with. If you offer gift ideas during the time of your trading or organization, you’re capable subtract all otherwise an element of the prices. Which chapter teaches you the new limits and legislation for subtracting the expenses from gift ideas.

You should account for the number you received from your workplace inside the year since the advances, reimbursements, or allowances. Including number you charged for the company by the credit card and other approach. You need to offer your boss a comparable type of info and support suggestions that you will have to give on the Internal revenue service if the Internal revenue service questioned a good deduction on the come back. You should repay the level of one compensation or any other debts allotment for which you wear’t sufficiently account otherwise that is more than the quantity for which you accounted. Among the laws for an accountable bundle is that you need to effectively account to the workplace for your expenditures.

This lady has authored and you can modified blogs to your personal financing subjects for more five years. Listed below are some much more what to watch out for regarding a lender indication-up added bonus. An informed bank indication-upwards bonuses is also get you numerous if you don’t several thousand dollars for many who be considered. Remember that the price tag limits one affect Level step 1 accounts create notapply so you can Level 2 accounts.

That it section explains simple tips to profile genuine expenses to have a rented automobile, vehicle, or van. You need to are any an excessive amount of depreciation on your own revenues and you may add it to your vehicle’s adjusted cause for the initial income tax year where you don’t use the automobile more than 50% inside the licensed organization explore. Have fun with Form 4797, Transformation of Company Possessions, to figure and you will statement the other decline on your revenues. For many who continue using your vehicle to possess business pursuing the recuperation several months, you might allege a good decline deduction inside the for each and every thriving tax seasons if you do not recover the base in the auto. The most you could deduct each year depends on the newest time you put the car operating plus company-play with commission.

Perform high-produce checking account prices change?

For the time being, banking institutions have to prepare solutions and you will show team in order to conform to the brand new casino Lucky Red login requirements — and you may considering the complexity, even waiting banking institutions is also deal with compliance exposure. Rarely annually passes instead biggest events, whether or not geopolitical, financial, or something like that completely unforeseen including a global pandemic, you to definitely significantly impression monetary places, the fresh cost savings, and you may financial institutions. Just last year is no exception, and you can 2024 is found on track to keep a difficult ecosystem — actually without any entirely unanticipated shocks. The same body known as the Cops Evaluation and you can Remark Administrator (PIRC) works in the Scotland. In the North Ireland, the police Ombudsman to possess North Ireland features a similar role in order to regarding the brand new IPCC and you will PIRC.

Not simply is someone magnetic by it, you can see the best image and you can clean sounds of the games. This really is a journey of discovery and you can adventure having rewarding awards, also to leave you riches. The brand new reels have the main characters, and there are right back tune songs whilst you play. If you want to speak about function outside the classic online game away from web based poker, then you definitely’ll getting delighted which have PlayAmo’s quantity of far more 20 on-line poker game.

In the one-fourth, put will set you back enhanced 6 basis issues when you’re mortgage output rejected 5 basis items. Financing efficiency were impacted by a seasonal lowering of mastercard financing. Inspired by the create-downs on the credit cards, the industry’s quarterly web fees-away from price stayed in the 0.65 % to your 2nd upright one-fourth, twenty-four base points higher than the previous year’s rate. The present day net fees-out of price is actually 17 base points more than the brand new pre-pandemic mediocre.

Increase your foundation by people ample advancements you make on the automobile, such adding air conditioning or a new motor. Reduce your foundation by one section 179 deduction, special decline allocation, gasoline guzzler income tax, and you will auto credit advertised. For those who change the access to an automobile away from a hundred% individual use to company explore in the income tax season, you might not has mileage details to your day before switch to business explore. In cases like this, you shape the fresh portion of business play with to the seasons since the observe. For many who utilized the fundamental mileage speed in the first 12 months out of team play with and alter to the genuine costs strategy in the an afterwards seasons, you could’t depreciate the car within the MACRS legislation. You need to explore straight line depreciation across the projected left helpful longevity of the automobile.

- An auto includes any region, part, or any other item in person linked to it otherwise constantly included in the cost.

- But by very early 2024, banking companies had enough deposits and you will become dialing back the eye prices they offered even while MMF productivity were still over 5%.

- You could ready yourself the brand new taxation come back your self, find out if you qualify for totally free tax planning, otherwise hire a taxation top-notch to prepare their get back.

- HSBC offers from 0.70% to at least one.45% p.a., depending on your own financial experience of her or him.

But not, when a student provides withdrawn out of college or university which is maybe not believed to go back, FWS fund might not be familiar with pay for performs performed following pupil withdrew. A correspondence pupil need fill in the initial accomplished class before finding a great disbursement within the FWS System. Your college can use any kind of payroll period it determines, offered pupils is paid at least monthly. It is smart to have the FWS payroll coincide in order to similar payrolls from the college or university.

Forbright Bank have highest output to your their deposit issues, but their Growth Family savings shines particularly and offers competitive productivity for the any harmony. The brand new account might be exposed online, there’s zero minimum starting put needs. Forbright Bank try called the best environmentally-amicable financial regarding the 2025 Bankrate Awards for its dedication to financing ecologically-amicable attempts. When you are looking for doing more of your financial at that eco-friendly lender, you may also open certainly one of the Development Dvds online but to locate a checking account, you’re going to have to go to a part, most of which have been in Maryland. The brand new Ascending Bank Higher Produce Savings account also offers a competitive focus rate however, a comparatively higher lowest starting deposit of $step 1,100000. You will should keep at the very least $step 1,000 in the account to make the brand new APY.

Yearly Declaration Monetary Overview

You should define the new go out out of disbursement since the numerous regulatory standards derive from you to day. That’s, a disbursement must be in direct regards to the genuine prices obtain from the student for that payment period. A college don’t have fun with most recent Label IV fund to fund far more than just $two hundred inside the past-seasons charges, despite students or father or mother authorization ($2 hundred overall, perhaps not inside per commission months in today’s honor season). Costs for courses and you will provides which might be organization charges would also getting prorated. Organization fees are generally those people to possess tuition and you will charge, room and you can panel, and other informative expenses that will be repaid to your school in person.